Trump Media, the owner of the Truth Social platform, saw its shares decline by nearly 10% on Tuesday after a volatile trading session marked by an unexpected halt due to rapid price swings.

Earlier in the day, the stock, listed as DJT, had gained over 13% but swiftly reversed, falling by more than 6% just before the trading pause at 2:47 p.m. ET. Once trading resumed, shares continued their downward trend, ultimately closing at $27.06.

This turbulent day saw over 97 million shares of Trump Media change hands, far exceeding the company’s 30-day average trading volume. The record-breaking volume marked the company’s busiest day since it went public in late March after merging with a blank-check firm.

The previous high came on July 15, following a reported assassination attempt on the majority owner, former President Donald Trump, during a campaign event in Pennsylvania. Trump, the current Republican presidential nominee, is a key figure driving investor interest in the stock.

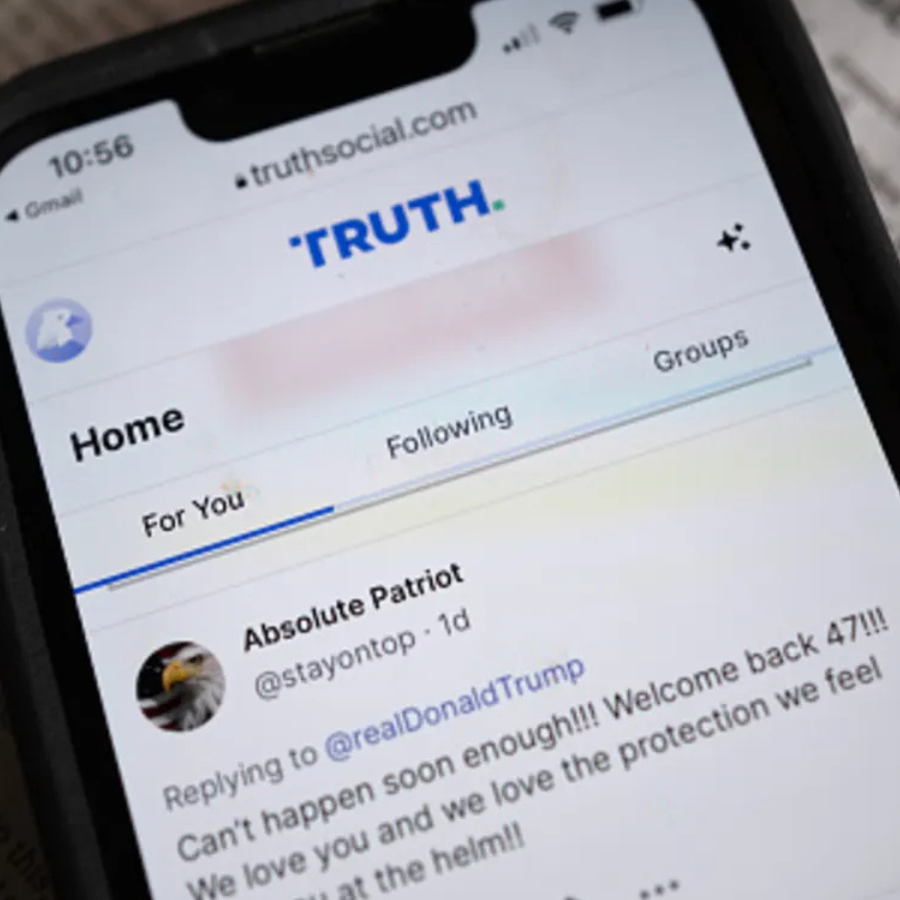

Many of Trump Media’s retail investors are supporters of Trump, and market analysts suggest that their trading activity is often linked to his political fortunes. They see the stock as a way to back Trump or as a bet on his chances against Democratic nominee Kamala Harris.

This week’s drop ended a steady increase in stock price that had been aligned with recent developments in the presidential race, which have energized Trump’s supporters.

Trump Media has benefited from fluctuating odds on online betting platforms, which recently shifted in Trump’s favor. These platforms are often popular with his base, although they don’t carry the same predictive power as traditional political polling.

For Trump Media, such shifts are reflective of a stock price that reacts not only to market dynamics but also to the political landscape.

As of September, Trump owns about 57% of Trump Media, a stake valued at roughly $3 billion based on Forbes’ estimates, accounting for a significant portion of his overall net worth. Trump, along with other major shareholders, was previously barred from selling his shares until the lockup period expired on September 19.

While Trump publicly declared he would not sell his shares, one key investor, United Atlantic Ventures, divested nearly its entire 11-million-share stake soon after the lockup lifted.

Adding to the day’s drama, Trump took to Truth Social early Tuesday morning, posting, “I LOVE TRUTH, THE REAL VOICE OF AMERICA!” This statement, coming amid the day’s volatility, seemed aimed at reinforcing his connection to the platform and bolstering confidence among his loyal base.

His words reflect how, for many investors, Trump Media represents more than a business venture—it’s a symbol of their broader political aspirations.

While the exact reasons for Tuesday’s sudden price drop remain uncertain, the trading halt underscores the stock’s susceptibility to rapid shifts tied to both market and political factors.

Trump Media’s high trading volume signals significant interest, but it also highlights potential risks for investors as the stock continues to be heavily influenced by Trump’s political trajectory.

This latest episode in Trump Media’s journey illustrates the complexities of a company so closely linked to a polarizing figure like Trump. The stock remains volatile, and investor sentiment is clearly intertwined with his political standing.

As the presidential race continues, Trump Media is likely to see further price fluctuations, driven by a mix of political developments and the actions of investors who view the stock as a way to express their support for or against Trump’s candidacy.

Ultimately, Trump Media’s performance underscores the unique position of a company where financial outcomes are so deeply tied to a single individual’s political fortunes. For now, the stock’s fate seems inseparable from the campaign trail, with each development impacting its value and driving investor actions.

Whether Trump Media can stabilize in the long term remains to be seen, but it’s clear that, for many, their investment is as much about Trump as it is about the company’s financial outlook.